Following up my last post, in this post i will put the abridged version of my master dissertation. At first, i hesitated to put this in blog because after reading it again after submission, i realized it was total shit. However, several days ago i received my final grade from the university and it way over what i expected. I got near perfect grade for my dissertation hence i was officially graduated Master of Science with distinction.

![Dissertation.png]()

Msc Dissertation

Due to those result, i decided to post the dissertation on my blog. I hope that it can be useful somehow especially for someone who wants to pick Indonesia / Jakarta / Slipi start up ecosystem as a research topic.

The whole document 21 thousand word long which i think is too overwhelming if i copy paste everything here. Hence i will post only certain chapters such as research background, context introduction, analysis, conclusion and limitation in order to be more digestable.

If youre interested in the full document, you can download it here.

If you just want to read the broad overview of my research and dont want to be bothered by this 6000 word post, check out this slide.

As an acknowledgement, this dissertation was written by me, Kiki Ahmadi , and supervised by Dr Elvira Uyarra. This dissertation was submitted to The University of Manchester for completion of MSc degree in the Faculty of Humanities in September 2017.

Abstract

In recent years, there is an increasing trend of internet startup creation in Indonesia driven by favorable macroeconomic indicator and infrastructure development. Majority of this startup are founded in the capital city of Jakarta with specific agglomeration happening in the area called Slipi. Drawing similarities from US tech cluster, the area was colloquially known as Slipicon Valley. Success of initial startups brought nationwide attention to Slipicon Valley however there is little information on how the cluster formed and what are the factors that influence them.

This dissertation is a study on Slipicon Valley cluster formation process. Using Feldman’s entrepreneur-led cluster formation theory, this dissertation aimed to build narrative description on how Slipicon Valley evolve overtime and examine the role of each supporting factors. The study also determines in which phase of cluster formation the Slipicon Valley currently is. Mixed-method analysis was used in the study, combining both spatial analysis using firm-level data and semi-structured interview with Slipicon Valley founders and managers.

The study identified rising trend of internet business and corporate spin-off as exogeneous events which sparked entrepreneurship activities in the cluster. Responding to emerging opportunities, actions by both individuals and corporation then influenced the development of supporting resource and institutions. The role of public policy in this process however is little to non-existent. This dissertation also argued that current Slipicon Valley has exhibited characteristics of a forming cluster. Nevertheless, it still lacked institutions and resources to be defined as mature, innovative, and adaptable cluster.

Keywords: Cluster, cluster formation, startup, entrepreneurship, regional dimension of entrepreneurship

Research Background

In recent years, Indonesia has been experiencing rapid growth in the digital economy. Driven by enormous middle class, increasing broadband penetration access and widespread infrastructure investment, Indonesia digital economy forecasted to grow from nearly 8 USD billion in 2015 to almost USD 80 billion by 2025 (Google & Temasek, 2016). This huge market potential has attracted homegrown and foreign entrepreneurs to build technology start-up to capture this opportunity. Tech start-up rate in Indonesia has grown by almost tenfold from 2010 to 2015 as indicated by number of funding and investment (Tech In Asia, 2016).

Out of around 800 identified tech start-ups in Indonesia, more than fifty percent are Jakarta-based start-ups (Crunchbase, 2017). This is not surprising considering Jakarta status as the capital of the country which enjoy the advantages of better infrastructure, higher internet penetration and faster economic growth compared to other cities in Indonesia (Financial Times, 2014). However, within the city itself, several tech start-ups are centrally concentrated in the urban area called Slipi. More than 40 start-ups are collocated here along with several venture capitals, business incubator and co-working spaces as reported by local news media (Jakarta Post, 2015) (Tech in Asia, 2015). Most of these start-ups are working in e-commerce, online travel, and digital media. Even though slightly different, the start-ups could be lumped into bigger categorization of internet and tech start-ups. This fits into the definition of cluster which geographical and sectoral concentration of similar firms (Porter, 1998). Because of this, the area was colloquially known as Slipicon Valley or Slipicon, a word play of Slipi and Silicon Valley (Jakarta Post, 2015).

The aim of this dissertation is to analyze the formation of Slipicon as emerging tech start-up cluster in Jakarta, Indonesia. Studying this process is crucial to understand how this cluster evolve and what are the factors influencing tech startup cluster formation in the context of Indonesia as a developing country. Outcome from this dissertation can be used as basis to develop policy program both to develop current Slipicon Valley further or another startup cluster within similar context.

The study will use cluster theories, regional dimension of entrepreneurship and cluster formation theories as theoretical lenses while also synthesize empirical data to gain comprehensive view of how Slipicon valley emerge. The research will use mixed-method analysis and the nature of the research will be exploratory.

Research Questions

The main research questions which will be pursued in this dissertation is:

How cluster formation happened in Slipicon Valley tech start-up cluster?

Since there is no prior research regarding this cluster, several analyses will be conducted to get a better overview on the context. Both quantitative and qualitative analysis will be used in the attempt to answer the main research question.

This will include spatial mapping analysis to obtain an overview on cluster, narrative-building to see how the cluster evolves overtime, and semi-structured interview to get primary information from Slipicon Valley cluster actors. In the later chapter of the dissertation, both conclusion of the study and limitation which came during the execution of this study will be explained.

Slipicon Valley Overview

Slipi is an area in the Palmerah district in the West Jakarta municipality. The area can be described as a growing urban sprawl filled with contrasting combination of big shopping malls and luxury apartments on one side, while on the other side are the universities, student houses and small business. The Slipi area is crossed by two main highways, the Jakarta-Merak Tollway and Tol Dalam Kota (Jakarta Inner Ring Road). The Jakarta-Merak Tollway connects Jakarta city to Tanjung Priok port, while the Jakarta Inner Ring Road gives direct access to the capital city’s main international airport, Bandara Soekarno-Hatta. As a result, people who travel both from the seaport and airport will always pass the Slipi and Palmerah district. Apart from the highways, the Slipi area is also well-connected by public transport both by bus and train. The city bus rapid transit network, TransJakarta, has three stops in the Slipi area through Corridor IX (TransJakarta, 2017). The commuter train network is also easily accessible from Slipi from Palmerah train station (Coconuts, 2015).

![Slipi Area Map.png]()

Jakarta Map with Slipi area highlighted in red while central business district is in blue

Recently, Slipi has been associated with the emerging technology start-up trend in Indonesia. The Jakarta Post, the most prominent English language paper in the country, reported that there are over 30 start-ups, digital companies, and venture capitals who have setup office in this area (The Jakarta Post, 2015). Tech publication, Techinasia, also said Slipi has the most population of start-ups, tech companies, venture capital and co-working space in the city (Techinasia, 2015). Drawing similarities with Silicon Valley in the US, the area is then colloquially known as Slipi-con Valley. Among the start-ups that are in Slipi-con Valley, several of them became very successful, thus further the popularity of the cluster as well. Two examples of these are Tokopedia and Traveloka which are the top 5 e-commerce companies not only in Indonesia but also in South East Asia (TechCrunch, 2016). The concentration of start-ups in the cluster has attracted overseas investors to set up a business presence and try to leverage the area’s potential in Slipi-con Valley. An example of this is Japan-based Cyber Agent Ventures which set up new office and co-working spaces in Slipi to be able to tap into the Indonesia tech start-up scene (Techinasia, 2015).

![Illustrative Map of Slipicon.png]()

Illustrative map of Slipicon Valley and its prominent start-ups (Techinasia, 2015)

The name Slipi-con Valley started as an internal joke between the founders and an employee who worked in the area (The Jakarta Post, 2015). However, there is no official source or information which describes how the term or the cluster first started. From Google Trends data which is depicted in figure 11, the terms Slipi-con Valley started to emerge in Google search results somewhere between end of May and early June 2015. Both articles which cover Slipi-con Valley in The Jakarta Post and Techinasia were posted during similar period (The Jakarta Post, 2015; Techinasia, 2015). This could be attributed to the growing trend of e-commerce in Indonesia in 2015 (TechCrunch, 2015; World Economic Forum, 2015). Slipi-con Valley is the home of several big local e-commerce players (Traveloka, Tokopedia, Blibli, Berrybenka). Consequently, the rise of this sector might increase the popularity of the cluster as well.

![Historical google search data.png]()

Historical google search data on “Slipicon Valley” term (Google Trends, 2017)

The origin of the Slipi-con Valley cluster might also closely tie in with the growth of the Indonesia and Jakarta tech start-up scene in general. The seed of the ecosystem can be trace back to post-dot-com-boom era of 1998 to 2001, which the first generation of Indonesian start-ups such as Detik.com (news site), Kaskus (community forum) and Bhinneka (e-commerce) first founded. However due to lack of business ecosystem and poor internet infrastructure, the scene went dormant (E27, 2012).

![Number of Startups Founded each year.png]()

Number of start-ups founded each year in Jakarta (Crunchbase, 2017)

As depicted in figure 12, the second coming started again circa 2008 – 2010, until today where there is a rise of newly-founded Internet start-ups mostly in news media, social network, and e-commerce (Techcrunch, 2010). The rising trend was attributed to an increasing development of the internet, personal computers, and mobile phones (E27, 2012). Tokopedia, one of the earliest and most prominent e-commerce business in Indonesia, moved into the Slipi-con Valley cluster during this era. In 2010, the US internet giant Yahoo acquired local social networking apps Koprol which put the Indonesian start-up scene into the global spotlight (TechCrunch, 2010). These start-ups attracted foreign investors and venture capitals to invest in Indonesian start-up hence incentivising more start-ups to flourish in the upcoming years. Two of those venture capitals (CyberAgent Ventures and Mountain Kejora Ventures) are in Slipi-con Valley. Many of the start-ups they invest in are in the cluster as well’ (Techinasia, 2015).

Slipi area is considered affordable in Jakarta. The average rental cost in Slipi and West Jakarta in general is cheaper than the CBD area in South Jakarta. However, Slipi is not the cheapest; there are many areas in Jakarta which are more affordable. In Figure 11 below, West Jakarta, where Slipi is located, is in the middle tier, while on the other hand, the East Jakarta rental price is almost half that of Slipi.

Within the Slipi area, there are three high-ranking private universities: Bina Nusantara University (Binus), Trisakti and Tarumanegara (The Jakarta Post, 2015). Binus particularly is well-known for their computer science programme. Every year Binus produces more than 3000 computer science graduates (Wartaekonomi, 2017). This is helpful for tech start-ups in the Slipi-con cluster which constantly needs software and hardware engineers. Binus graduates are also known to be entrepreneurial. There are currently eight successful tech start-ups founded by Binus graduates, including the founder of Tokopedia which is also one of the earliest tenant in the Slipi-con valley cluster (E27, 2017).

Venture capital businesses are also plentiful in the Slipi-con valley cluster. Out of sixteen listed venture capitals in Indonesia, five are in the Slipi-con Valley cluster: Mountain Kejora, Cyber Agent, GDP Venture, Merah Putih and Ideabox (Inc42, 2017). Mountain Kejora and Cyber Agent are foreign investors while the other three are local companies. GDP Ventures are spin-off founded by Djarum Group, the biggest tobacco company in Indonesia. The Djarum Group office complex are in Slipi hence GDP venture use their office building. Some of the venture capital companies, such as Mountain Kejora, have co-working space for their start-ups to use in their premise. Consequently, these venture capital businesses are actively adding new tenants to the cluster, especially in the early stages of a start-up, because they benefit greatly from lower rentals’.

In terms of a social network, there are specific organisations or communities tailored for the founders or employees in Slipi-con Valley cluster. However, there are several communities which routinely hold events in the cluster. Most of the events are free and they become meeting points for individuals from various background who are interested in tech start-up movement in Jakarta. There is StartupLokal, which is the first tech start-up community in Indonesia. It was founded in 2010 and they hold monthly free-for-all sharing sessions events with an average attendance of 200 people each time (Meetup, 2017). Another one is Girl in Tech Indonesia which is a community specific for tech start-up female founders and employees. It was founded by Ollie Salsabeela, a serial entrepreneur. Her current company is in the cluster, and community meetings are often held at her office.

One thing the cluster lacks is government support. Even though the cluster has been covered several times in the media, and foreign investors are already coming in to the cluster, there is no support in terms of policy or funds. There are no known initiatives or intentions yet from public sector bodies to support Slipi-con Valley, despite the rising popularity of the cluster.

Quantitative Findings on Slipicon Valley

There have been several attempts to map the Slipi-con Valley cluster before, however these were done in a very simplistic way (Techinasia, 2015; Qerja, 2015). This dissertation will attempt to remap the cluster in a more comprehensive way using the location data of 453 Jakarta-based start-ups listed in CrunchBase.

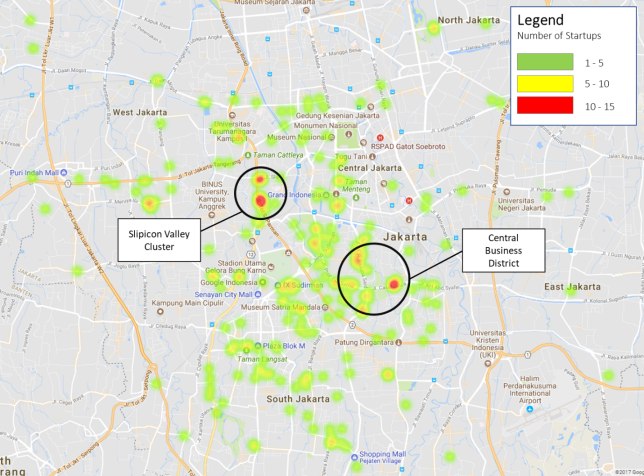

Initially, the mapping of all the start-ups for the whole of Jakarta will be shown. This is to see the concentration of start-ups in the Slipi-con Valley cluster compared to other areas in the city.

As depicted above, the locations of start-ups in Jakarta was quite scattered all over the city except for two noticeable agglomerations in the Central Business District (CBD) and in the Slipi-con Valley Cluster. The concentration of firms in CBD is not surprising, considering most of the business, financial and political establishments are in the area. It is the number one top office spot in Jakarta with the highest office space demand (Colliers, 2017). Slipi however is quite new and unique because the area was not traditionally seen as business areas especially for technology companies.

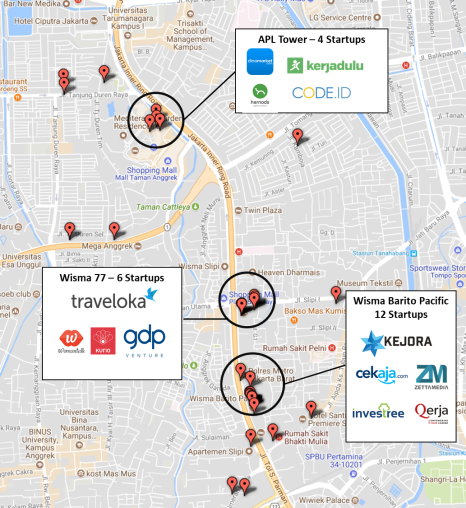

Zooming in to Slipi-con Valley, the cluster is currently the home of forty-one start-ups. As depicted in figure 13 below, most them are co-located mainly in three main locations: APL Tower, Wisma 77 and Wisma Barito Pacific. All three of them are prime office building areas located strategically along the Jakarta Inner Ring Road. A possible explanation for this is because of the venture capital businesses, GDP Venture and Kejora, which are in Wisma 77 and Wisma Barito Pacific respectively. Kejora specifically have co-working space in their office hence most of their investment is also located there. The APL tower however does not have venture capitalists in their premises. Nevertheless, the building is part of Central Park shopping mall complex which attracts many visitors daily.

![Cluster Map]()

Slipicon Valley cluster map with information on the concentration area of start-ups

In terms of the business sector, the bulk of start-ups are in the e-commerce business. The three biggest start-ups in Slipi-con Valley (Traveloka, Tokopedia and Blibli) are all e-commerce services. Apart from e-commerce, start-ups offering software development services and venture capitals are also prevalent in the cluster. In terms of operating age, half of the start-ups in the cluster are less than 3 years old; only two firms have been operating more than 7 years. In terms of size, almost 60 per cent of Slipi-con Valley start-ups have between 50 to 200 employees. In addition, there are significant small and micro-sized small firms, while there only handful of big start-up with more than 200 employees. From this composition, it can be concluded that the typical start-ups in the Slipi-con Valley are mid-sized e-commerce companies with less than 3 years operation. A detailed composition chart can be seen in figure below.

![startup composition.png]()

Composition of startups in Slipicon Valley Cluster

The earliest record of a tech start-up located in Slipi-con Valley cluster area is from 2008. It was Dinomarket, one of the early Indonesian e-commerce start-ups which was located there. Tokopedia, which is currently the biggest e-commerce website in the country, moved in to the cluster not long after, however there were no meaningful increases in the tenancies held in the cluster at that time’. The first spike happened in 2008 to 2010 following the rise of internet start-ups in Indonesia (Techcrunch, 2010). During that period, the number of start-ups doubled and Djarum group, the biggest tobacco company in Indonesia, started their first tech start-up venture Blibli.com (Techinasia, 2011; Wall Street Journal, 2012).

The tobacco company doubled down their investment in tech start-ups by creating their own venture capital arm GDP ventures (Techinasia, 2013). The Djarum office is in Slipi, and consequently both Blibli and GDP venture is located nearby. The establishment of GDP venture contributed to the second spike in the Slipi-con Valley start-ups was in 2013 to 2014.

In the following year, Indonesian tech start-ups started to become internationally recognised. Many foreign investors saw the potential in the country start-up scene and started investing in the country. Two of the most successful tech start-ups in the country were in the cluster. On the other hand, a couple of venture capitals also setup presence here. This led to an increase in media coverage on Slipi-con Valley, which helped the popularity of the cluster to develop as well.

Slipicon Valley Evolution

There are three defining features of a cluster: geographical concentration of firms, social network, and shared values (Porter, 1998; Cruz & Teixeira, 2010). In the case of Slipicon Valley, some of the feature are clearly shown while the others are vague. As described in figure 12 and 15, there is an obvious concentration of technology start-up compared to the rest of the city with further specialization in E-commerce. Existence of social network is exhibited even though not strongly. Majority of the interviewee stated that their start-up did not have regular collaboration with another firms within the cluster (see chapter 4.3.4). Regular collaboration happens only between start-ups within the same VCs and it is centrally coordinated by them. The prevalence of this type of relationship is a common trait of an emerging cluster (Menzel & Fornahl, 2009). However, there many knowledge sharing sessions which facilitate people from different background meet in the cluster. Some of the founder in Slipicon Valley also initiated couple of start-up community even though it’s not exclusively for entrepreneurs in the area.

The third characteristics, shared values, is not yet visible in Slipicon Valley. There currently no community organization, government policy or social institutions which cater specifically for firms in Slipicon Valley. Hence start-ups in Slipicon Valley didn’t have access to supporting public goods commonly found in a cluster (Porter, 1998). There is also no sign of investment by private sector to create joint-facilities which can be used collaboratively by cluster firms. For example, several venture capitals developed co-working space in Slipicon Valley however they can only be used by start-ups under their investment (Techinasia, 2015).

Slipicon Valley is a relatively new cluster and has only been around for less than a decade. As described in the findings, earliest sign of tech entrepreneurship was recorded in 2008 however increasing trajectory didn’t happen until 2011 and 2014. Both quantitative data and interview results pointed out that the cluster started getting popular around 2015 where success of several start-ups within the cluster attracted media spotlight. From then on, public become aware of Slipicon Valley as tech start-up cluster as signified by its regular appearance in Google search term (Google Trends, 2017).

![evolution of slipicon.png]()

Evolution of Slipicon Valley cluster

In the beginning of a cluster, a region may have couple of entrepreneurship-supporting factor however start-ups are limited (Feldman, et al., 2005). As an urban area in a capital city, Slipi has ample latent entrepreneurship potential. For starters, three universities in Slipi area provides steady pool entrepreneurs since they tend to start in location which they’re familiar with (Sternberg, 2009). Universities also help entrepreneurs to recruit skilled labor (Bresnahan & Gambardella, 2012). Digital creative business grows better in a big and diverse urban economy where variety of ideas and people are widely available (Duranton & Puga, 2001). Affordable rent and its proximity to Jakarta central business district (CBD) also attractive features for entrepreneurs. Both features are the known driving factors in the growth of other tech start-up cluster such as Silicon Alley in New York and Silicon Roundabout in London (Hutton, 2008; Nathan & Vandore, 2014). Findings from the interview results also confirms the importance of affordability factor (see chapter 4.3.2 and 4.3.3). Considering all of this, the next question is to find out how does latent entrepreneurship sparked into active entrepreneurship seen in the current Slipicon Valley cluster.

Cluster formation process started when there is an exogenous shock events which shifted latent potential to active entrepreneurial activities by creating a crisis, industry discontinuity or arising opportunity (Feldman, et al., 2005). In the case of Slipicon Valley, I identify two events which sparked start-up activities in the cluster: rise of digital business in Indonesia and spin-off activity by big corporation located in Slipi (Djarum). How these two events sparked latent into active entrepreneurship and kickstart cluster formation process in Slipicon Valley will be described in the next chapter.

Role of entrepreneurs

Starting from 2010, Indonesian digital economy was growing rapidly due to increasing enormous middle class, increasing broadband penetration access and widespread infrastructure investment (E27, 2012; Google & Temasek, 2016). Combination of both favorable macroeconomic indicator and infrastructure development opened new opportunities in the area such as e-commerce, social media, and varieties of another internet business. Entrepreneurs is a person which able to perceive new opportunity and acting upon them (Blanchflower, et al., 2001). Many individuals reacted to this new opportunity by founding tech start-up. Considering Jakarta status as capital city with better internet and spending power than the rest of the country, most of these entrepreneurs are based in Jakarta (Techcrunch, 2010). Slipi become prime location of choice for this newly established start-up due to its many favorable conditions as described in previous section. Even though digital economy is growing nationally, it influenced cluster formation locally in Slipi due to entrepreneurship-supporting factor that the area has.

On the other hand, this trend not only attract individual entrepreneur but also big companies to venture into this market. One prominent example of that is Djarum, biggest tobacco company in Indonesia which has been operating since 1950s (Djarum, 2013). The company founded ecommerce company called Blibli.com in 2011 (Techinasia, 1120). Djarum is based on Slipi hence Blibli was located nearby both to save cost and facilitate coordination with parent company (see chapter 4.3.2). In 2013, Djarum then setup their own venture capital called GDP venture which also located nearby their office.

From this, the decision of Djarum to setup Blibli.com and later GDP ventures can be both entrepreneurial response to exogenous events while also becoming another exogenous event by itself. It is an entrepreneurial response because like individual founder, Djarum as a company see the opportunity emerging from this new internet trend decided to setup business entity in this sector (Techinasia, 2011; Techinasia, 2013). However, Djarum actions is also exogenous shock events by itself because it lowered the opportunity cost for subsequent tech start-up founders. When they started Blibli.com, Djarum status as a big company gave legitimacy and positive signaling to this new digital economy sector which are still rife with uncertainty. When they started GDP Venture, Djarum further decrease opportunity cost for new entrepreneur by offering financing, mentoring, connections and (Ferrary & Granovetter, 2009).

In the later stages of Slipicon Valley, the success of early entrepreneurs shaped the cluster. For example, two e-commerce companies Tokopedia and Traveloka were established in the cluster prior to 2012. In 2015, these two start-ups achieved magnificent growth and considered first Indonesian start-up who reached valuation of one billion US dollar (Techinasia, 2015). Increasing media coverage on both start-ups and the fact that both located in the same place hence popularized Slipicon Valley terms (Jakarta Post, 2015). Finding from Google search data (see figure 11) and interview results (see chapter 4.3.1) confirmed this argument. Success of the initial start-ups also attracted more physical and human capital to the Slipicon Valley as exhibited by string of foreign venture capital setting up presence in the area (Techinasia, 2015).

Entrepreneurs also played a role in creating new resource to protect or promote their interest. This can be seen in the form of community and sharing session which often held in the cluster. From the interview result, one of the respondent (Salsabeela from Zettamedia) stated that she initiated two start-up communities to facilitate idea sharing and collaboration. Another respondent also mentioned that their start-up held sharing session both to share ideas and promote their start-ups for potential hires.

Role of local environment

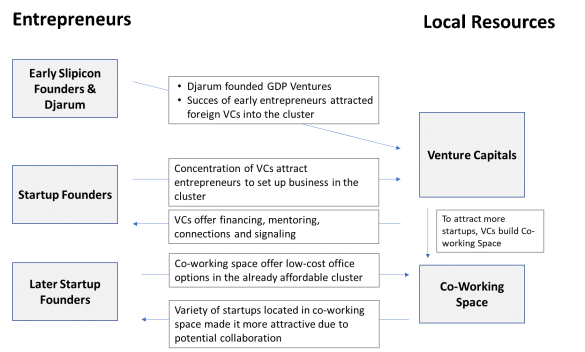

A cluster is a group of multiple firms and institutions with aligned interest (Maskell & Malmberg, 1999). In the cluster formation process, local environment is both influence and being influenced by actions of entrepreneurs (Feldman, et al., 2005). In this chapter, several evidences how these dynamics played out in Slipicon Valley will be discussed.

From the interview results, one of the important institution which influenced entrepreneurs to move to Slipicon Valley the proximity to venture capital (see chapter 4.3.2). This is an example of entrepreneurs being shaped by the environment. As described previously, heavy presence of VCs were the result corporate entrepreneurship actions and success of early Slipicon start-ups (Techinasia, 2013; Techinasia, 2015). From this point of view, it’s the early entrepreneurs which influenced the development of the environment.

Furthermore, some the VCs developed co-working space as a low-cost space options within their Slipicon Valley office (E27, 2014; Techinasia, 2015). This action created additional institutions which influence location decision of potential entrepreneur even more. One of the respondent stated that they decide to locate in a co-working space because it facilitate potential collaboration with other start-ups (see chapter 4.3.2). Following this argument, the more start-up in the co-working space increase the attractiveness of the place and more likely to influence another start-up to locate in the same space. Hence, collaboration potential is another resource which are born from interaction between entrepreneurs and environment. In conclusion, back and forth dynamics between founders (as entrepreneur) and venture capital (as local environment) shaped the development of both as depicted in Figure 18 below.

![how entrepreneurs and local resource influence each other.png]()

Illustration on how entrepreneurs and local resource influence each other’s in Slipicon Valley cluster

Role of public policy

Public policy is unseen in the development of Slipicon Valley. Findings from both quantitative and qualitative did not find any interaction between Slipicon Valley entrepreneurs and its local resource with public policy instruments. In a cluster formation, Policy can play a role as the cause for exogenous shock in the early stage or as incentives to spur development in the later and more mature stage (Feldman, et al., 2005). Exogenous shock in Slipicon Valley cluster was caused by combination of both improvement in economic indicators and local corporate actions rather than specific policy changes. Lack of support from either local or national policy-maker in Slipicon Valley might be an evidence that the cluster economic contribution is not yet significant enough. One of the interview respondent also commented that the lack of government support is understandable considering the rapid rise of tech start-up scene while on the other hand Indonesian government in infamously slow (see chapter 4.3.5). This is not surprising considering inefficient government is the top inhibiting factor of doing business in Indonesia (World Economic Forum, 2017).

In 2016, central government initiated a national programme promising 1000 start-ups by 2020, with a total valuation of USD 10 Billion (Techinasia, 2016). The initiatives consist of various programmes, from mentoring to incubation in several of major cities in Indonesia including Jakarta. There is also another incubation program lead by another government institution, Creative Economy Body of Indonesia, called BEKUP (Techinasia, 2017). However, both initiatives did not leverage or involve the Slipi-con Valley cluster directly, even though the cluster is the home of several very successful start-ups in Indonesia.

Current stage of Slipicon Valley in cluster formation process

First stage of cluster formation process is Dormant stage where an inert area with latent entrepreneurship potential suddenly shifted to active potential due to exogenous event (Feldman & Francis, 2004). Slipicon Valley is passed this stage as the latent potential, multiple exogenous event and the sign of active entrepreneurship is clearly evident and it has been described thoroughly in previous chapter.

Next is a Formation stage where entrepreneurial activities were increasing, interaction between entrepreneurs and environment started to happen and the entrepreneurs started to build resource to protect and promote their interest. All of this is also shown in Slipicon Valley. Both emerging tech start-up trend and Djarum investment in GDP ventures increased number of start-ups in the cluster. The sign of entrepreneurs and environment interaction has already occurred in the form interaction between founders and VCs as described in section 5.3. Lastly, start-up communities and sharing session events which initiated by in Slipicon Valley entrepreneur themselves is an evidence of how start-up founders develop resource for promoting their interest.

The last stage is Established stage. A cluster which have reached this stage have fully-functional resources and institutions to be an innovative and versatile entrepreneurial environment (Feldman & Francis, 2004). Examples of institutions commonly found in this stage are network of entrepreneurs, policy makers and firms offering secondary industry service to cluster start-ups. In the current Slipicon Valley, network of entrepreneurs is prevalent but formal partnership is still limited. Policy makers are still non-existent and secondary industry is also not significantly visible. One of the respondent mentioned that there is one start-up in the cluster which offer lunch delivery services which several Slipicon Valley start-ups are subscribed to. However, it is only one firm and their target market is more to general population rather than specifically targeting start-ups (Techcrunch, 2015).

Another feature of cluster in an established stage is reputation for specific technology (Feldman & Francis, 2004). This reputation was built on combination of initial start-up success and critical mass of firms. Having a reputation, a cluster will be able to attract external investors and government policies. Reputation will also signify reduction in opportunity cost hence activities such as spin-off, merger, and acquisition will often be seen in Established cluster.

Slipicon Valley reputation for tech start-up is starting to establish. This can be seen in how success of Tokopedia and Traveloka raised the cluster fame and already invited foreign capital into the Slipicon Valley (TechCrunch, 2015; Techinasia, 2015). However, public policy involvement is not yet seen. One might argue, Slipicon Valley still hasn’t reach critical mass of start-ups or its reputation is still not sufficient. Spin-off, merger, and acquisition are also not yet evident from Slipicon Valley initial start-ups.

![current stage of Slipicon Valley cluster.png]()

Description of current Slipicon Valley within Cluster Formation Process framework

As depicted in Figure 19 above, I believe Slipicon Valley is currently still in the Formation stage. Several characteristics of Established stage has occurred however many important institutions which are crucial in developing innovative and versatile cluster is not there yet.

Conclusion

Main objective of this dissertation is to explore how cluster formation process happened in Slipicon Valley. Using theoretical model of cluster formation as the basis, three analyses have been done in the process of fulfilling this objective. First, narrative description of the Slipicon Valley has been established to see how the cluster evolve overtime. Second, the role of entrepreneur, local environment and public policy has been examined to see each factor contribution in the development of the cluster. Lastly, by comparing latest condition of the cluster with features of each cluster formation stage, Slipicon Valley current position in the whole formation process has been determined.

Within its relatively young age, Slipicon Valley has exhibited most of the characteristics of typical industrial cluster. Slipicon Valley possess latent entrepreneurship potentials due to its location in the capital city urban area, steady supply of university graduates and cheap rental cost. Early footprint of tech entrepreneurship has been showing since 2008 however spike in entrepreneurial activities didn’t happen until 2011. Rising trend of internet business in Indonesia act as an exogenous event which attracted many entrepreneurs into the area. Djarum decision to invest in this business also further shaped Slipicon Valley. In 2015, huge success of early start-ups brings media spotlight and subsequently foreign venture capital into the area. This development further increases number of start-up in the cluster.

During the cluster formation process, entrepreneurs both individual and corporation played key role in influencing how the cluster adapt and evolve itself. Djarum actions to develop start-up and venture capital within their existing office not only shaped early form of the cluster but also influenced the development of local resources. Initial e-commerce start-ups such as Tokopedia and Traveloka which founded as a response to emerging new opportunities, managed to grow successfully which in turn raised the popularity of the cluster. Both entrepreneurial actions lead to the concentration of venture capital which is the top reason start-ups move in the cluster. Following the cluster evolution over time, there were no sign of public policy contribution in Slipicon Valley development. The cluster economic contribution and reputation might not yet big enough for to warrant attention from policy maker.

Slipicon Valley is currently in a formation stage in the entrepreneur-led cluster formation framework (Feldman, et al., 2005). It already exhibited some features of the established cluster however it still lacks some of the defining features to be defined as fully-functioning, innovative and adaptable cluster as described in the theoretical model.

Limitation and Further Studies

First limitation acknowledged in this dissertation is cluster formation process analysis was done using in one cluster (Slipicon Valley) within specific local and national context (Jakarta, Indonesia). Insights from this study might not simply generalized into different cluster even if it is within the same city. As described in the findings, within Jakarta itself there are other agglomeration of start-ups in the CBD area. Further studies comparing these two clusters might be beneficial to develop better generalization of cluster formation process within the capital city of an emerging country.

Second limitation is the number of firm data used in quantitative analysis. Crunchbase have around 400 entries on Jakarta tech start-ups however there are other database which have larger data sets such as Techinasia (~3000 data) and E27 (~1800 data). However, data in those two databases are in unstructured form hence significant effort on data extraction need to be done before it can be used for analysis. Considering time limitation, Crunchbase data was used in this study because its already structured and can be downloaded in excel format. Hence, data analysis can be done faster and easier. Further development of this dissertation using more data from the two databases could paint more comprehensive picture on Jakarta and Slipicon Valley start-up agglomeration. Bigger data pool might also valuable in analyzing Slipicon Valley in a longer period since the earliest data points in Crunchbase is only from 2008.

Third limitation is the number and composition of the interview respondents. Due to distance and time limitation, this dissertation only managed to get 10 respondents which consist of 7 managers and 3 founders. Even though I have tried my best to look for senior people in the start-ups, questions regarding location decision might be better answered by the founders of the company. There is also potential bias since the respondents were selected starting from my personal connection and then snowballed from there. Further studies involving wider number of start-ups and more balanced number of founders and managers might produce more comprehensive insights.

Lastly, public policy study is a crucial part of this dissertation. However, in this dissertation, existence of public policy related to Slipicon Valley is probed only using desktop research of secondary data in news media, report, or academic publication. I believe more exhaustive research can be done by getting policy maker as interview respondent in the next studies. Current dissertation conclusion that public policy played little to no role in Slipicon Valley formation can be tested and challenged further.